As Governor Landry targets high auto insurance premiums, Louisiana drivers might get relief.

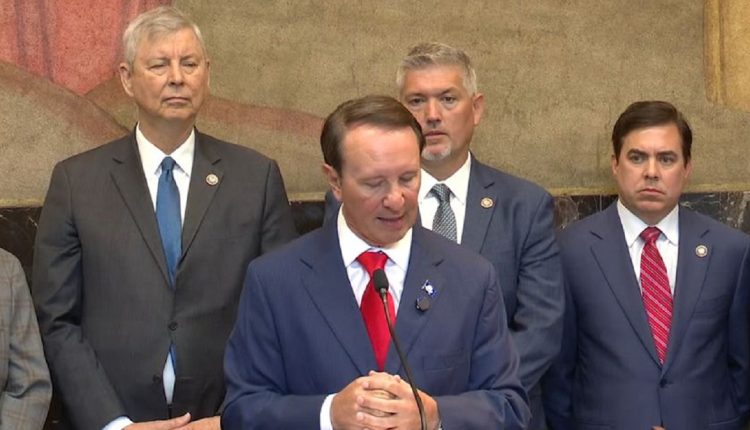

BATon ROUGE, LA – This week Governor Jeff Landry presented a revolutionary legislative proposal meant to lower Louisiana’s outrageous vehicle insurance rates. While giving drivers across the state top priority, the proposal tries to balance responsibility for insurers and personal injury attorneys.

The Auto Insurance Crisis in Louisiana: Demand Reform

Governor Landry called vehicle insurance “one of the most pressing issues” taxing Louisiana households at a Wednesday news conference. Landry stressed the pressing need of a “balanced approach” to change since premiums regularly rank among the highest in the country, surpassing the national average by notable percentages.

Although Louisiana’s collision rates match the national average, our injury claims are double. That is the issue we are addressing, Landry said, citing statistics showing the state’s outlier status in minor injury claims and litigation rates.

Important Components of Landry’s Insurance Reform Plan

Landry’s proposal targets Louisiana’s excessive minor injury claims, which he claims influence rates. Reforms might curtail aggressive advertising by personal injury lawyers and minimize lawsuit incentives.

The proposal aims to increase the regulatory authority of the Louisiana Insurance Commissioner so that fair industry practices may be guaranteed and insurance companies cannot pass marketing expenses to policyholders.

Transparency and Responsibility: Landry said, “I’m here to help citizens—not lawyers or corporations”— stressing holding both insurance and lawyers responsible.

Reactions of the stakeholders: concerns and support

Although Landry’s proposal gives drivers who are cost-conscious hope, industry analysts like Armond Schwing of Schwing Insurance Agency caution of unforeseen consequences. “Louisiana’s injury claims outlay 200% higher than those of surrounding states. Reforms meant for insurers could backfire and cause rates to rise even more. Schwing warned.

Critics contend the state’s litigation culture, with lawsuits 200% more probable than the national average, calls for more thorough structural changes. Advocates of the emphasis on stopping advertising practices and overstated promises, meantime, applaud.

Data Driving the Shift: Crash Rates Against Injury Claims

Louisiana matches the national average in accidents.

Minor injury claims reflect twice the U.S. average.

With injury claims costing 59% more, annual premiums exceed national rates.

Future Announcements from the Insurance Commissioner

Set to discuss the proposed changes Thursday, Louisiana Insurance Commissioner Tim Temple provides analysis of regulatory changes and their implementation dates.

Will Landry’s proposal cut Louisiana’s auto insurance rates?

Drivers look for practical solutions to relieve financial burden as Governor Landry’s auto insurance reform picks steam. Emphasizing data-driven solutions and shared responsibility, Louisiana might establish a model for other governments facing comparable problems.

Keep informed: Follow for Thursday briefing by Commissioner Temple and breaking news on auto insurance changes in Louisiana.